I remember when Steele Creek Apartments were proposed for the Southeast corner of Steele Street and 1st Avenue, at the time occupied by a few Class C buildings and a discount dry cleaner.

With the news hitting that the building set a new record on a per-unit basis for the sale of an apartment building of $570,000 per unit does the valuation make sense even considering future equity appreciation?

Working in both New York and Denver such numbers are not surprising as in NYC such a deal would be a steal especially for a newer construction building minus any rental controls, statutory affordable housing or long-term leases. Yet Denver is not New York.

Granted we have seen other close to blockbuster deals in Central Denver concerning rental properties as excerpted below from my morning daily read BusinessDen including but not limited to:

- 1000 Speer (formerly Joule) – $535,714 per unit

- Uptown Square – $467,706 per unit

- Moto – $395,000 per unit

- Line 28 – $359,000 per unit

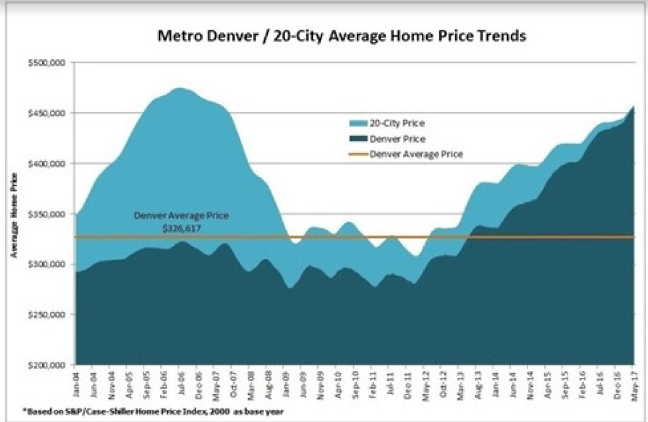

However are these deals good money-chasing returns, which are far from guaranteed? One could argue Denver at present is in an up cycle with record high rents (even though some buildings are offering rental incentives). Yet I am concerned as follows:

The New Rental buildings are oriented to deluxe and luxury tenants offering studio to 2-bedroom configurations limiting marketability to affluent singles and couples. In New York and San Fracisco the highest prices on bith a per-unit and PSF basis are “family-oriented” apartments considering of usually 2-4 bedrooms and minimum 2 bathrooms where a family can be reside comfortably.

Is there a glut on the horizon in the marketplace? Between Lower Downtown and Cherry Creek along the Speer Boulevard/1st Ave. corridor we are witnessing new buildings sprouting up like weeds with the assumption that demand for luxury rental apartments will continue unabated.

The Millennial Generation Will Age: I am witnessing it in my real estate practice; millennial’s are pairing up, starting families and due to price pressure are looking at homes to purchase in outlying Denver and suburban neighborhoods; not much different how Brooklyn became chic when Manhattan rents became unaffordable (with some help from Michelle Williams and Maggie Gyllenhaal and for us old timers, Patty Duke lived in Brooklyn Heights).

If the Influx Slows Who Will Rent these Apartments? While certain buildings have a reputation for attracting empty nesters (25 Downing Street) and those whose change in lifestyle may necessitate move to an apartment from a home (The Seasons at Cherry Creek), while renting is an option, many opt to purchase. Again anecdotally I know two empty-nest couples who moved from Country Club to condos, one in downtown, one in Cherry Creek.

What is Trendy Today is a Maintenance Headache Tomorrow: We see this in buildings throughout Capitol Hill, the party rooms with the naugahyde chairs on brass wheels and the pool table that has seen better days or the pool which requires constant expensive maintenance and upkeep.

While I understand the attractiveness of the cost on a per unit basis when compared to other in-demand cities including San Francisco, The Northeast Corridor (from Boston to Washington DC), Los Angeles and so forth those cities have physical geographic constraints and draconian rent-control laws which circumvents true market supply and demand laws thus raising rents on the free-market inventory.

Thus I do not see how the numbers work based on existing rental rates even when factoring in equity appreciation and nominal inflation. Granted there is always the option of conversion from rental to condo. The process includes upgrading the common areas and interiors of unitsoriented to the for-sale market AND developing a legal condominium, HOA and so forth. Not unheard of in Denver i.e. The Barclay (which when first converted were offered with developer backed below-market financing), Brooks Towers and other buildings have experienced such conversion.

However at present transaction cost per unit, is there really the demand for the $600K one bedroom condominium? We have seen such sales in smaller boutique developments including 250 Columbine (which does have a Starbucks on the retail level), but it is rare and definitely a niche market.

From experience such condos sell to those looking for a pied-a-terre in which their primary residence is NOT Denver or potential investment however for a decent cash-on-cash return the rents do not justify the selling price.

In New York City developers take the opposite approach developing condos and if the plan if sales do not meet the pro-forma then re-branded as a rental with the option to sell individual units when the market strengthens.

At present looking at prices coupled with construction activity I would be “short-selling” the apartment market if such a vehicle existed. Long-term I may be proven wrong, however within the three-five year time horizon and even in the present as leasing entities/developers are offering rent concessions, I would be more concerned versus excited at the blockbuster record prices being recorded.